Years ago our industry adopted the ‘Know Your Customer’ (KYC) guidelines to verify identity, assess risk and prevent fraud. This straightforward concept has helped many financial institutions dramatically cut identity theft, money laundering and other forms of suspicious behavior.

Can KYC help beyond identity verification? Customers today have come to expect a high-touch, personalized experience. What if we were to leverage KYC from a different angle—to improve the customer experience. It turns out that ‘knowing your customer’ is also a great strategy for customer service, especially in our increasingly digital-first world. Your customers are seeking the same convenient digital engagement options for banking as they use in their personal lives. In fact, they are starting to demand the choice of chat, voice and video, based on what is most convenient for them at the time.

Knowing your customers can help your financial institution provide an experience that keeps them fully engaged, lowers abandonment rates and drives up customer satisfaction (and loyalty). That starts by knowing how they want to communicate. What if they could connect with your institution however they feel most comfortable—with the ability to seamlessly move to other channels, as needed, without disruption?

Imagine if customer service representatives could actually see a customer’s screen to remove ambiguity, instantly understand the service need and provide quick support that leads to a satisfying experience. This has been a technology challenge … until recently.

Digital Customer Service vs Multi-Channel

While many banks have adopted a multi-channel approach to customer service, the consumer experience is often fragmented. That’s because many institutions have bolted a group of disparate point solutions together with separate silos for chat, voice and video. The experience starts to break down when a customer needs to shift to another channel. A customer wants to speak to the representative, for example, rather than typing a long response. Most banks ask the customer to call a separate phone number, which breaks the digital connection. It also leads to high abandonment rates and customer frustration.

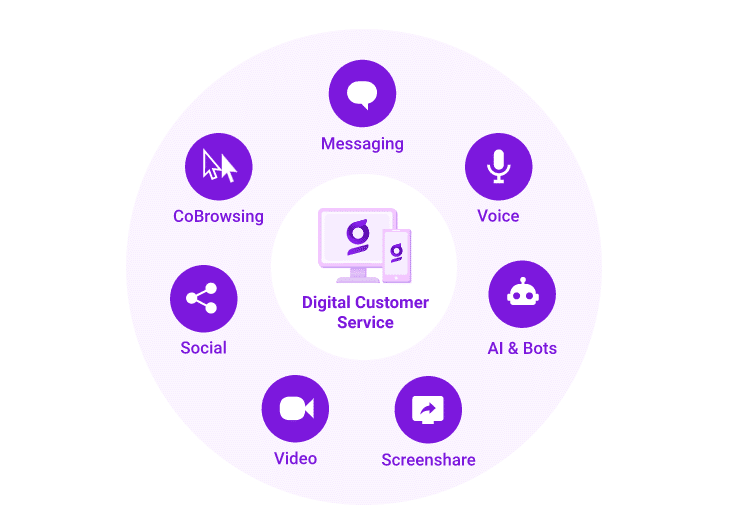

Digital Customer Service (DCS), on the other hand, provides a seamless approach that allows customers to engage via any channel and quickly move to another, all within a single digital journey. A customer in chat, for example, can speak to that representative with the push of a button. OnScreen voice keeps the digital journey intact. Or for a more personal touch, a representative can offer video chat.

Keeping PACE

Beyond offering customer options and an easier way to provide service, DCS helps your financial institution develop a closer relationship with your customers. It helps you ‘Know Your Customer’ better. In fact, we like to say it helps you keep PACE with them.

PACE is an acronym to help financial institutions offer exceptional customer experiences through DCS. They focus on 4 key elements:

- Personalize: The experience should be ABOUT the customer–not just that they are recognized by name, but there is a demonstrated level of understanding about that person’s history with a company, the nature of their past interactions and what they are likely seeking from the company at that moment.

- Automate: Through the use of integrated AI and machine learning, chatbots can be instantly triggered based on certain keywords, issue descriptions or click patterns. If a customer needs basic information or to perform a simple self-service task, a chatbot can deliver this in a fully-automated manner without the need for live assistance.

- Contextualize: If a live agent is called into the customer’s resolution journey at any time, through Live Observation and CoBrowsing they are able to join the discussion mid-stream (where the customer is at that moment), rather than forcing them to start the interaction all over again at the beginning.

- Educate: We’ve all heard it a million times: “Give a person a fish and they will eat for the day. Teach a person to fish and they will eat for life.” Instead of conducting a transaction for a customer, in DCS an agent can enable a customer to complete the transaction themselves (with a bit of helpful guidance), in a way that inspires customers to be more confidently self-sufficient in the future.

Each of these elements was created as a direct response to the negative experiences so many customers have reported in the past when interacting with companies whose customer service “machine” was built on a disconnected multi-channel chassis.

By adopting Digital Customer Service, you can begin to really Know Your Customer and deliver service that exceeds expectations, lowers the abandonment rate and drives up both conversions and satisfaction rate. It’s all about DCS and keeping PACE.